The most respected partner in the global recruiting market

Find your best jobs

Various senior and executive positions in a wide array of industries and functions

-

Notice

[Year-end & New Year Business Hours] Our office will be closed for the New Year’s holiday from Tuesday, 30th December to Sunday, 4th January. We will reopen for business on Monday, 5th January.

-

[Job Alert Delivery Service – Temporary Suspension Starting December 4, 2025] Read more here.

-

[October 15, 2025 (Wed) – Regarding SMS messages pretending to be from en world Japan employees] Read more here.

Explore Jobs by Category

Jobs by Industry

Financial Services

Construction & Real Estate

Consulting & Professional Services

IT & Telecommunications

Manufacturers, Trading Companies, Retail

Medical

Advertising, Publishing, Media

Services & Entertainment

Energy, Resources & Infrastructure

Transportation, Logistics & Warehousing

Jobs by Function

Executive Management, Corporate Planning, Business Planning

HR

Legal, General Affairs, Administration

Finance, Accouting

Legal & Compliance

SCM, Procurement, Logistics

Sales

Marketing, Sales Promotion, Product Development

Consultant

Real Estate

Technical Roles (IT, Web, Telecommunications)

Technical Roles (Chemicals, Materials, Food, Cosmetics, Consumer Goods)

Technical Roles (Automotive, Industrial Machinery, Mechanical Parts)

Technical Roles (Semiconductors, Electronics)

Architecture, Construction, Plant Engineering, Renewable Energy

Life Sciences (Pharmaceuticals, Medical Devices, Healthcare)

Services & Distribution

Creative

Jobs by Annual Salary

Jobs by Company Type

Jobs by Contract Type

Jobs by Level

Workplace Type

Examples of our Client Partners

New Jobs

*Please note that job listings may be updated or closed without prior notice.

Featured Jobs

*Please note that job listings may be updated or closed without prior notice.

en world's desire for "enabling success"

Our commitment to "enabling success"

At en world, we do not view a career change as a "moment" of joining a company but rather as a "journey" that begins the moment you take the first step toward a new career and continues even after you join a company.

Real voices of people who have made a career change to Global Companies

The people that en world had the opportunity to support have a very high stick rate, and we believe that this is because we aim to find the best possible match between our clients and job-seekers.

The messages shared on this page are just a few of the many positive voices we have received from our customers who have used our services.

Candidate Success Stories

We hear from so many candidates who have found success in new roles that we have introduced to them. We get constructive criticism from time to time as well, and we always work to make sure that it reaches the consultants in order to improve our service.

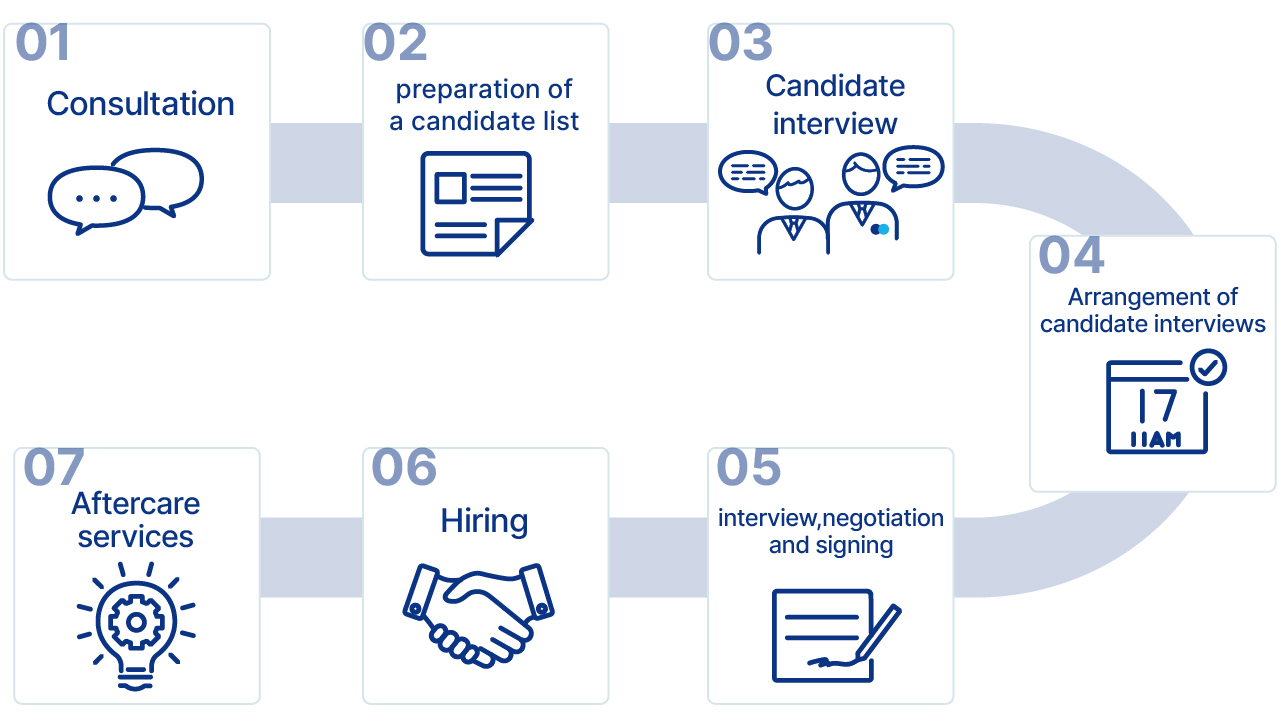

The Placement Process

Candidates should feel free to reach out to a consultant at any stage in the process if they have doubts or if anything is unclear. Our consultants have developed deep industry and functional specialization so as to be able to support candidates well in finding new roles and advancing their careers.

For those who wish to change jobs as " Professionals(Professional Contractors/Freelancers)", please refer here.

en world Japan is a recruitment partner for foreign capital and Japanese multinational companies that supports mid to high level jobs that leverage English language skills. We work with over 90% of all foreign capital companies in Japan and have the industry's top class number of positions available. We have access to abundant job information from a wide range of companies seeking global talent, from global companies with international and industry recognition to promising start-ups. We have a large number of confidential jobs as well as high-class jobs that allow remote work and annual incomes of 10 million yen or more. Our diverse and professional consultants will introduce and recommend high-level jobs that suit each individual jobseekers. en world Japan will do its utmost to support your career development and career building through your job search.

Find your best jobs

Various senior and executive positions in a wide array of industries and functions